Getting rejected for a loan can feel like a kick in the teeth. No way around it, rejection is painful. But a loan rejection may be a gift in disguise. All too often, borrowers get the loan they want and end up wishing they hadn’t because they can’t afford the payments.

Lenders have good reasons for denying loans; they need to know you will be able to repay the amount you borrow from them. With some effort, you can turn your credit situation around so that you get approved for a loan you can afford the next time you apply. Here’s how to get started.

- Find out why you were rejected—Upon reading those “We are sorry but …” words in your rejection letter, you may feel the urge to crumple and pitch the letter into the trash. Instead, read it, in full. That letter has useful information about the exact reasons for your loan denial. Maybe you’re late on paying bills, or the lender feels you’re already borrowing too much compared to your income.

- Get a copy of your credit report—The denial letter also will state which credit bureau the lender used in making the loan decision. And it will tell you how to contact the agency to obtain a free copy of your credit report. Get a copy and check it over closely.

- What to do if you find errors—Mistakes are not uncommon. If you find any errors on your report, contact the credit bureau. Ask that a corrected copy be sent to any lender that recently received the inaccurate report. Check for errors in your report at the other two bureaus, too.

- Get expert help—Start by talking with the people at your credit union. Someone there may be able to work with you to devise a credit repair plan, or you may get a referral to a free or low-cost outside counseling resource.

With a little investigative work and some clean-up, you’ll be on your way to getting a “yes” on your next loan request.

Source: cuna.org

Related Articles

Good Debt/Bad Debt

Not all debt is necessarily bad, particularly when it can help you build wealth. It’s important to know the difference and how to sort the good from the bad.

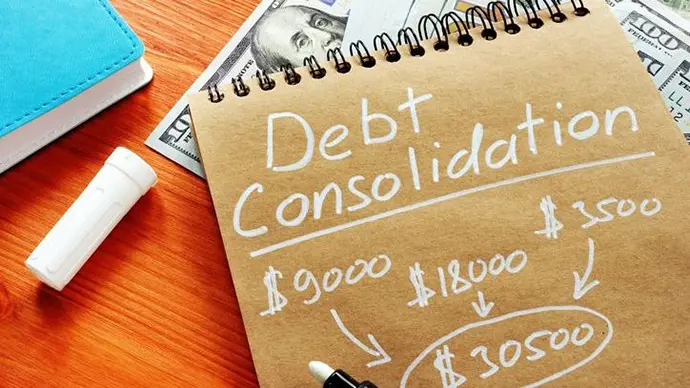

The Case for Debt Consolidation

Consolidating your credit card bills into a single loan can be a wise financial move.